Common Bankruptcy Terms for Bankruptcy Filers

Automatic Stay

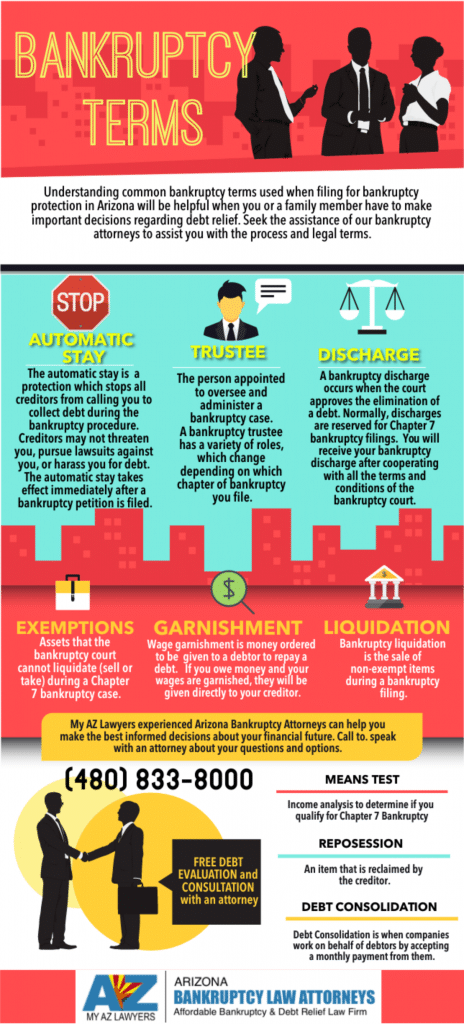

Individuals who file for bankruptcy are granted automatic stay at the time of their filing. This is a common bankruptcy term that our attorneys are often asked. This is a protection which keeps all creditors from calling the filer during the bankruptcy procedure. Individuals who have been harassed by creditors or threatened with lawsuits will be protected from these calls and threats during the automatic stay period.

Bankruptcy Trustee

A bankruptcy trustee is the person appointed to oversee and administer a bankruptcy case. The bankruptcy trustee is someone appointed by the U.S. Department of Justice or by the creditors in a bankruptcy case to oversee the proceedings of the bankruptcy case. A bankruptcy trustee has a variety of roles, which change depending on which chapter of bankruptcy you file. The 2 most common types of bankruptcy are Chapter 7 and Chapter 13. The trustee is responsible for reviewing your bankruptcy petition, looking for fraud or any red flags and maximizing the amount of money your unsecured creditors will get through bankruptcy. Our Mesa bankruptcy lawyers will act as a liaison between you and the trustee.

Bankruptcy Discharge

A bankruptcy discharge occurs when the court approves the elimination of a debt. Normally, discharges are reserved for Chapter 7 bankruptcy filings. You will receive your bankruptcy discharge after cooperating with all the terms and conditions of the bankruptcy court. One of the more straight-forward common bankruptcy terms.

Exemptions

Exemptions are assets that the bankruptcy court cannot liquidate (sell or take) during a Chapter 7 bankruptcy case.

Garnishment

Monies given to a debtor to repay a debt. When money owed a debtor is ordered given to a creditor to repay the debt owed. If you owe money and your wages are garnished, they will be given directly to your creditor. Filing bankruptcy will stop most garnishments through the automatic stay. Garnishments can be tricky and should be taken seriously. Garnishment is one of the more common bankruptcy terms and reason for people declaring bankruptcy.

Liquidation

Liquidation, one of our common bankruptcy terms, is usually linked with a chapter 7 bankruptcy filing. Bankruptcy liquidation is the sale of non-exempt items during a bankruptcy filing. In some cases individuals are required to sell some of their valuables in order to use those profits for the repayment of outstanding debts. In many Chapter 7 cases, though, filers don’t have any non-exempt assets, so liquidation rarely occurs during a Chapter 7 bankruptcy.

Means Test

The 2005 Bankruptcy Act Means Test requires that your income and expenses be analyzed to determine if you qualify to file for a Chapter 7 bankruptcy or if you need to file for a Chapter 13. The court looks at your average income for the six months prior to filing and will compare this to the median income in the state of Arizona. If your income is below the median, you have the right to file for a Chapter 7. If your income exceeds the Arizona median, then the means test will determine that you can only file for a Chapter 13. Don’t forget, it is your right to be able to file for bankruptcy protection in Arizona.

Meeting of Creditors (341 Hearing)

The meeting of creditors is a court-appointed meeting which takes place during a bankruptcy. At this meeting, creditors affected by a bankruptcy filing are free to attend and oppose the bankruptcy if they see the necessity to do so. Many creditors won’t attend these meetings, but they are an opportunity for all parties involved to discuss any concerns that they may have. Our Mesa bankruptcy lawyers will attend the 341 Meeting of Creditors with you.

Debt consolidation

Debt consolidation is another type of debt relief. Debt Consolidation is when companies work on behalf of debtors by accepting a monthly payment from them. These companies split up the payment to their various creditors. Debt consolidation one of our common bankruptcy terms associated with debt relief options other than declaring bankruptcy. In theory, this provides the debtor with a more easily manageable way to pay their debts.

Repossession

If you have an item that is repossessed, it is something that is reclaimed by the creditor. Repossession often happens when a debtor fails to make payments on time. For example, if you default on your car loan, your lender might repossess your car. Repossession can be stopped by filing for bankruptcy protection and is a common bankruptcy terms usually linked to vehicles, boats, motorcycles, RV’s, and other toys.